Q13. How do I login to view and enroll in benefits?

A13. Benefit information is stored on the benefits enrollment system. You can view your benefits at any time during the year by clicking the “Enroll/View Your Benefits” button. During Annual Enrollment you will be able to make changes to your benefits using this same button. If you are logged into a Marquette system, the button will take you right to your information without additional log-in steps (you are authenticated as a Marquette employee once you have logged in to start your computer or have used email or another Marquette system requiring authentication). If you are not logged into a Marquette system, you will receive a prompt to provide your email address and password.

Please note: all benefit enrollments can be done at this site EXCEPT TIAA retirement information which is on the TIAA site.

Q14. Can I enroll on my own or must I use a Benefits Educator?

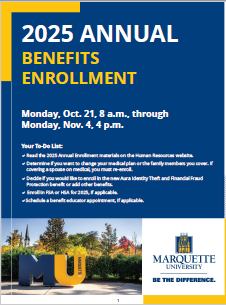

A14. To enroll in your 2025 plan year benefits, you may speak with a Licensed Benefits Educator via a phone or virtual appointment, or you may enroll yourself by Nov. 4, 2024. You may schedule your phone or virtual appointment beginning on Oct. 14 by visiting marquettebenefitsenrollment.com or by calling (877) 759-7668. The appointment will allow you time to ask specific questions regarding the benefits, compare offerings, and make the best decision for your individual needs with the help of a benefits educator. You may also use the benefits enrollment system to complete the enrollment on your own beginning Oct. 21.

Benefits Educators are licensed, non-commissioned advisors (contracted through Optavise) who can answer your questions about Marquette’s health insurance options and other optional benefit programs. Appointment slots are set during the annual enrollment period.

Q15. Will I get an email confirming my appointment?

A15. Yes. You will receive an email from noreply@timetap.com.

Q16. How do I join my Benefits Educator phone or virtual appointment?

A16. If you scheduled a virtual appointment, there will be a link to join the meeting in the confirmation email. This is NOT a Teams call, please join from the link in the email. If you scheduled a phone appointment, the Benefits Educator will call you directly at your appointment time.

Appointments are limited, so if your plans change please call (877) 759-7668 to cancel or reschedule.

Q17. What information will I need when enrolling?

A17. Be sure to review the 2025 Annual Enrollment Guide prior to enrolling. Along with your personal information, if you would like to enroll a spouse and/or dependent child, you must have their date of birth and Social Security number to complete your enrollment. Once your enrollment is complete, you will need to upload a copy of the birth/adoption certificate for enrolled dependent children and/or marriage certificate for an enrolled spouse in the online enrollment tool (unless you have done so in previous years). You can view the document upload instructions at marquettebenefitsenrollment.com.

Q18. Can I make a change during the plan year once my elections are made?

A18. There are certain IRS regulations that allow you to make a change during the plan year if you experience a Qualifying Event.

Any change you make due to a qualifying event needs to be consistent with that change. For example, if you were to marry during the plan year, you could add your spouse to a plan or waive coverage if you decided to be covered under your spouse’s plan. However, this event would not allow you to move from one medical plan to another. Similarly, if you gave birth to a child, you could add that child to your current plan(s). Please note that any changes need to be made within 30 days of the event.

The list below includes many of those events.

Qualifying Events

- Marriage, divorce, legal separation or annulment

- Birth or adoption of a child

- Obtaining legal guardianship of a child

- Change in employment status for your spouse or child that affects benefit eligibility, including commencement or termination of employment, or change in worksite

- You or your dependent become eligible or lose eligibility for Medicare or Medicaid

- The death of your spouse or child

- Court ordered coverage of your child by you or your spouse, allowing you to add or drop the child’s coverage

- Loss of eligibility for a child, including graduation or reaching age limitations

- Change in your MU employment or work hours that affects benefits eligibility

- Change in your access to health care due to annual enrollment through your spouse or a substantial mid-year increase in premiums.

Q19. What can I do if my spouse’s annual enrollment has already closed this year?

A19. Your spouse’s annual enrollment is considered a qualifying event that would allow you to make a new election. For example, if your spouse’s annual enrollment was held in September and you waived coverage through your spouse’s employer and now want to make a new election based on the options Marquette is offering, your spouse would need to contact their employer to ask about making the change. You might be asked to submit documentation of Marquette’s annual enrollment dates. If so, your spouse could show their employer the flyer you received in the mail to substantiate the dates.

The same process would apply if your spouse’s annual enrollment occurs at any other time of year as well.

Q20. Why is Marquette charging spouses more for medical insurance?

A20. Marquette University continually strives to maintain high quality and cost-effective medical coverage for all our employees. While Marquette University continues to offer spouses coverage, we believe that every employer bears the responsibility of providing medical benefits to its own employees. Spouses who have the option to take medical coverage with their own employer, but choose to take Marquette’s medical plan coverage instead, will automatically be assessed a $100 monthly spousal surcharge. This charge will only apply if your spouse is eligible for medical coverage through their own employer (or is in a partnership and self-employed for tax purposes) but chooses instead to enroll in the Marquette Medical Plan. Employees must re-certify their spouse’s coverage every year during the annual enrollment period.

Q21. How will employees notify Marquette of the other coverage their spouse has available?

A21. The spousal surcharge will automatically be assessed for employees enrolling for Employee + Spouse, or Family medical coverage, unless they complete the spousal surcharge waiver on the enrollment system during the annual benefit enrollment process. The completion of the waiver will be required each year during the annual benefit enrollment period. Waivers can also be completed in the enrollment system as a result of a qualifying life event (e.g., loss of coverage, marriage, etc.) and will become effective the first of the month following the requested change.

Q22. Am I able to enroll different family members in medical, dental and vision coverage? For example, my children are young and may not need vision coverage yet.

A22. Yes, for example you can enroll your whole family (yourself, spouse and children) in a medical plan, but only yourself and your spouse in dental and vision, if that’s all they require. However, remember to enroll them the following year if you think they will need coverage at that time.

Q23. How can I be sure that my elections and dependent information have been successfully updated?

A23. If enrolling with a Benefits Educator, a confirmation statement will be sent to your email address on file once you have completed your 2025 Plan Year enrollment. If you enroll on your own, you will be prompted to print or email yourself the confirmation statement upon completion of the enrollment.

This confirmation statement will reflect elections you have made at Annual Enrollment to be effective as of Jan. 1, 2025, as well as reflect enrolled dependents/spouse. Please review carefully for accuracy and save a copy of the statement for your records.